Introduction

In the dynamic world of accounting, the selection and implementation of IT solutions have become pivotal for firms striving to enhance efficiency and maintain a competitive edge. As the landscape evolves, characterized by rapid technological advancements and shifting client expectations, accountants must navigate a myriad of options to identify the most suitable tools for their specific needs.

From cloud accounting software that offers unparalleled flexibility to automation tools that streamline repetitive tasks, the choices available can significantly impact operational success.

This article delves into the critical considerations for choosing the right IT solutions, best practices for implementation, and the transformative advantages of adopting innovative technologies in the accounting profession.

By understanding these elements, firms can position themselves to thrive in an increasingly complex environment while meeting the demands of their clients and the industry at large.

Choosing the Right IT Solutions for Accountants

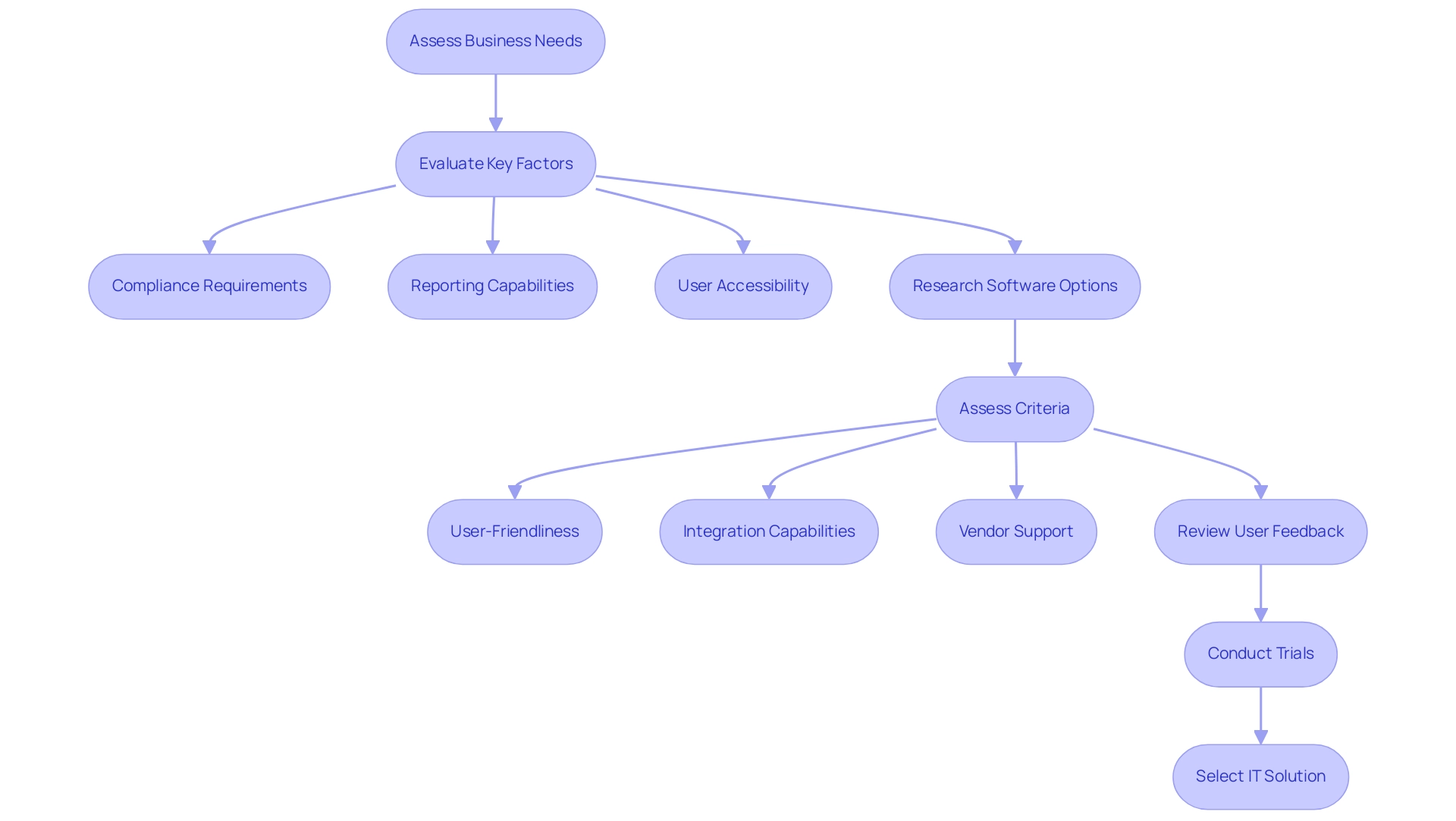

Choosing the appropriate IT solutions for accountants for financial management necessitates a thorough needs assessment customized to the unique requirements of your business. Begin by evaluating essential factors such as compliance requirements, reporting capabilities, and user accessibility. As the accounting software market is anticipated to reach $11.7 million by 2026, propelled by innovations in cloud systems and advancements, it's essential to examine various software alternatives critically.

Consider options like QuickBooks, Xero, and Zoho Books for their potential to meet your firm's needs. Key evaluation criteria should include:

- User-friendliness

- Integration capabilities with your existing systems

- Level of vendor support available

Furthermore, with 31% of accountants currently utilizing AI tools for research, leveraging technology can significantly enhance efficiency.

It's prudent to review user feedback and conduct trials to assess effectiveness in real-world scenarios. Notably, a case study titled "Tech-Advanced Clients Boost Business" highlights that 29% of accountants' clients are considered tech-advanced, leading to increased efficiency and job satisfaction for accountants. Scalability also plays a vital role; choose options that can evolve alongside your business and adapt to the dynamic technological landscape.

In a market where 68% of clients favor assistance from both human and Robo-advisers, ensuring that your firm provides IT solutions for accountants to meet diverse client needs will position you for sustained growth and operational excellence. As Tradeshift notes, the total B2B payments in the US in invoices will reach $23 trillion, underscoring the importance of selecting robust IT solutions for accountants that can manage such significant financial transactions. Lastly, consider user satisfaction ratings and recent reviews of financial software to further inform your decision-making process.

Best Practices for Implementing IT Solutions in Accounting

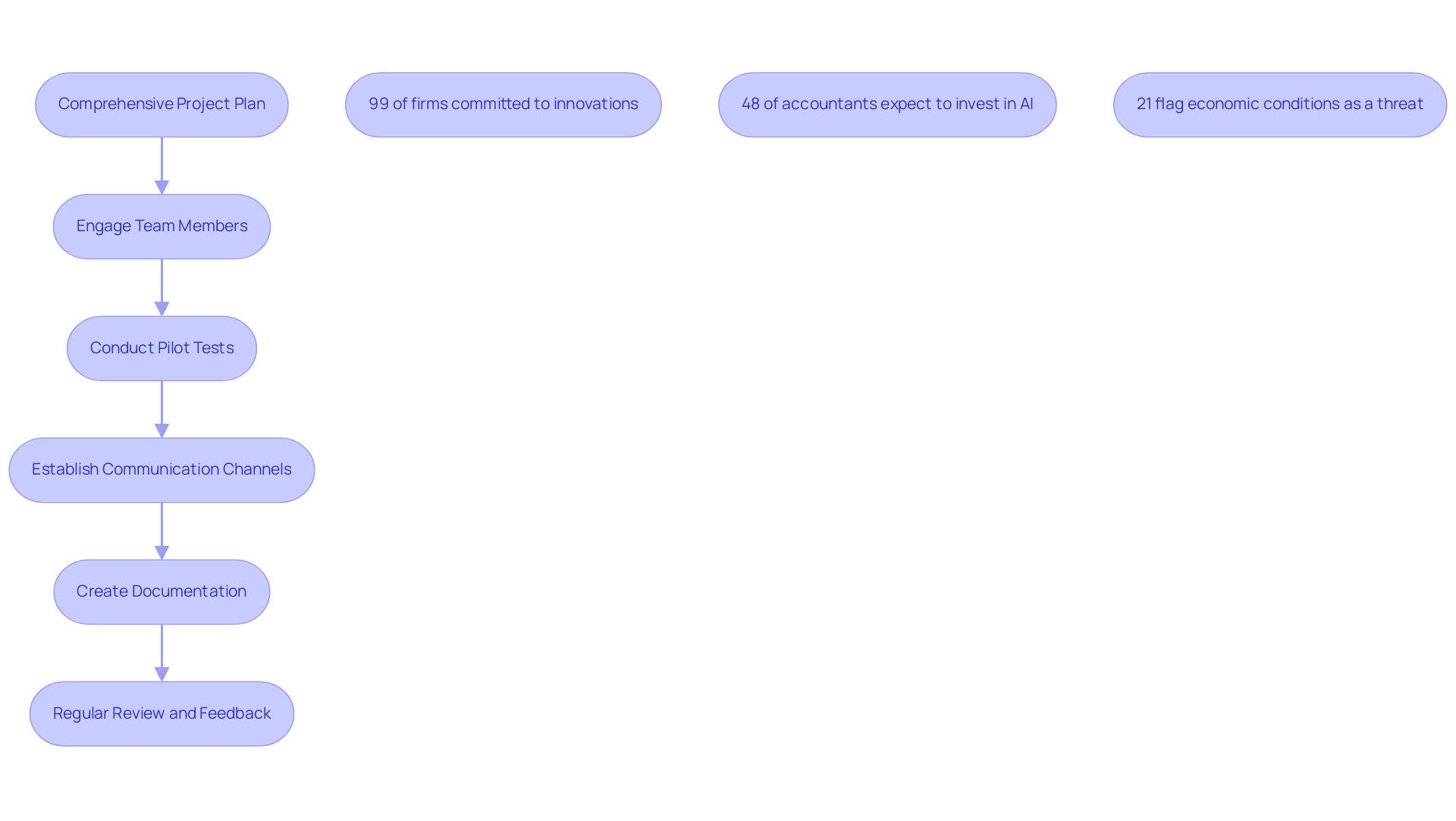

Implementing IT solutions for accountants requires a meticulous, structured approach to ensure success. Begin with a comprehensive project plan that delineates timelines, identifies key milestones, and assigns responsibilities to stakeholders. Engaging relevant team members at the outset is vital; their input fosters a sense of ownership and commitment to the project's goals.

As part of the implementation process, conducting pilot tests is crucial. These preliminary trials help identify potential issues and enable user feedback, allowing for refinements before full deployment. Following implementation, establishing effective communication channels for ongoing support is essential, along with creating detailed documentation that outlines processes and troubleshooting steps.

Regular reviews of the system's effectiveness should be conducted, accompanied by soliciting user feedback to facilitate continual adjustments and improvements. Such practices are becoming more vital as:

- 99% of firms express a commitment to embracing the latest innovations to improve operational efficiency and attract top talent, especially in a difficult economic environment where 21% of industry professionals identify economic conditions as a substantial threat.

- 59% of accountants consider clients' use of technology when assessing client fit, underscoring the importance of technology in client relationships.

In addition, a QuickBooks survey reveals that:

- 48% of accountants expect to invest in and adopt AI and automation tools over the next 12 months, highlighting the industry's shift towards IT solutions for accountants.

A relevant case study on selecting the right financial software illustrates that firms must research options that align with their unique needs, enhancing operational effectiveness by narrowing down choices based on specific goals.

The Advantages of Cloud Accounting Software

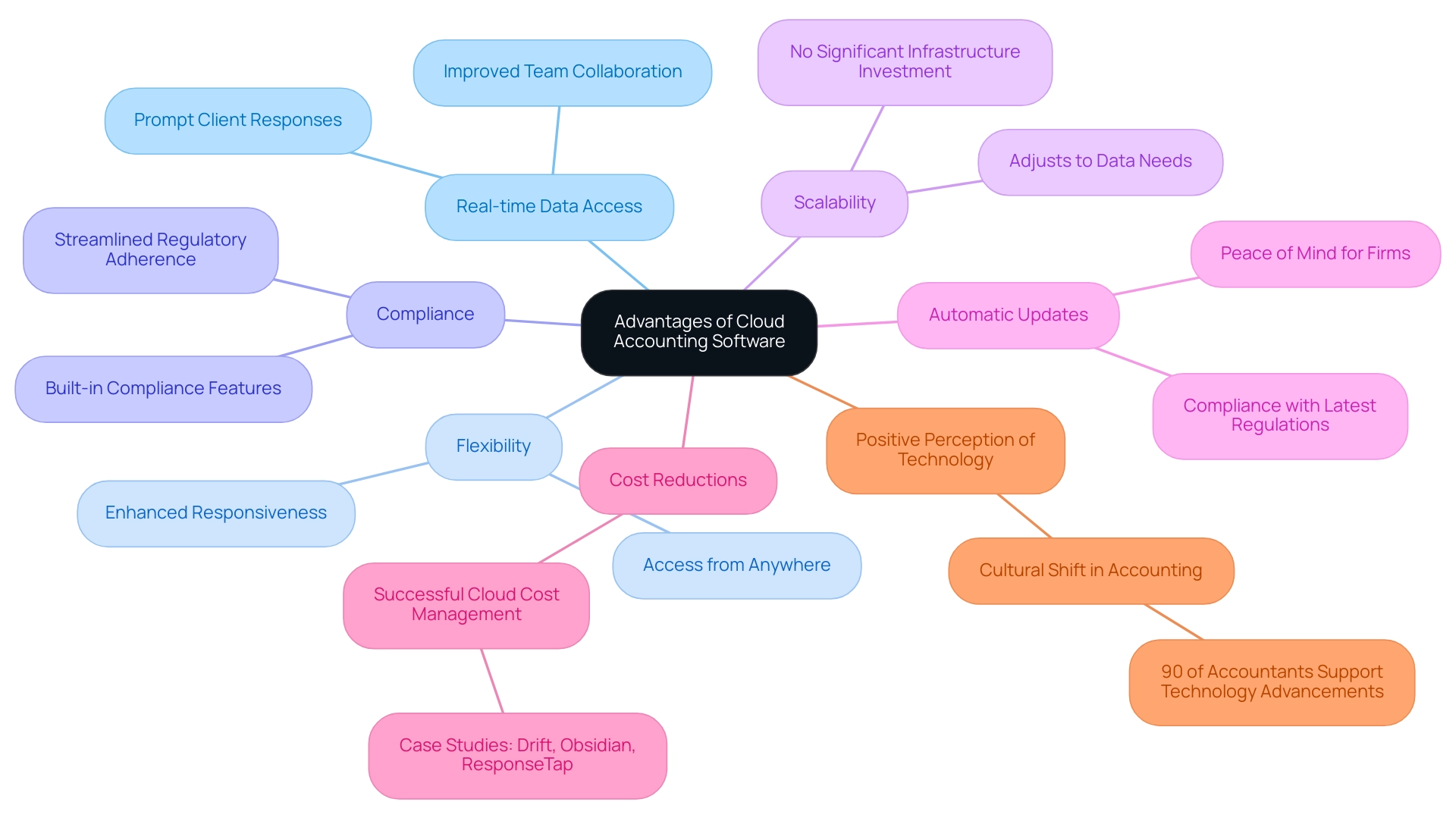

Cloud accounting software serves as one of the key IT solutions for accountants, offering a multitude of advantages that are reshaping the landscape of the accounting profession. With over 21% of organizations choosing cloud services, the advantages are becoming increasingly clear. Real-time data access through IT solutions for accountants enables accountants to respond promptly to client inquiries, fostering improved collaboration across teams.

Platforms like Sage Intacct and FreshBooks enable organizations to operate from virtually anywhere, enhancing flexibility and responsiveness. Additionally, these cloud offerings serve as IT solutions for accountants by incorporating built-in compliance features, streamlining the process of adhering to regulatory standards. Scalability emerges as another essential benefit of IT solutions for accountants; as organizations expand, these solutions can effortlessly adjust to increasing data needs and user demands without requiring significant infrastructure investments.

Automatic updates ensure that IT solutions for accountants remain compliant with the latest tax regulations and accounting standards, offering peace of mind for firms navigating the complexities of financial governance. Importantly, organizations like Drift, Obsidian, and ResponseTap have reported significant reductions in their cloud expenditures through effective cloud cost management strategies, emphasizing the tangible advantages of embracing such innovations. Additionally, major corporations such as Microsoft, IBM, Oracle, SAP, and Intuit have shown robust financial performance in the cloud sector, enhancing the trustworthiness of cloud offerings.

Sage emphasizes this transformation, noting that > 90% of accountants believe that technology advancements are fueled by a cultural shift within the profession. This perspective underscores the importance of adopting innovative IT solutions for accountants that align with current industry trends.

Leveraging Automation for Enhanced Accounting Efficiency

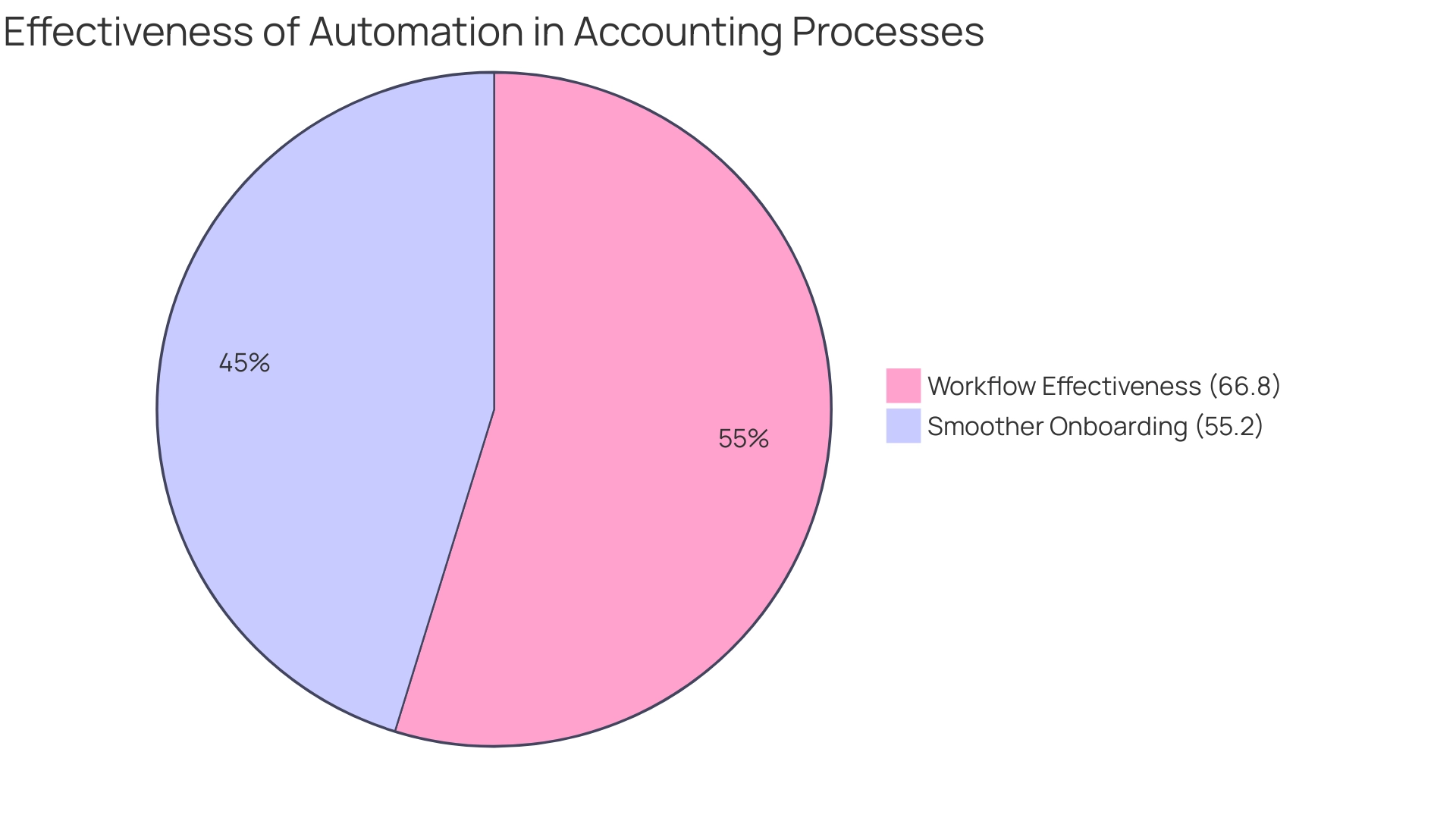

To significantly improve accounting efficiency, it is essential to leverage IT solutions for accountants that are designed to manage repetitive tasks such as invoicing, data entry, and reconciliation. Tools like Bill.com and Receipt Bank exemplify how automation can revolutionize invoice processing and expense management, highlighting the importance of IT solutions for accountants that free your team to concentrate on higher-value activities, including financial analysis and strategic planning. According to recent findings, 66.8% of companies measure the effectiveness of workflow automation through the seamless operation of systems and processes, underscoring the importance of these tools.

Additionally, 55.2% of users reported that automation made their onboarding process smoother, highlighting its role in enhancing overall operational efficiency. The case study titled "The Role of Technology in Workflow Management" illustrates that the integration of IT solutions for accountants and advanced workflow management tools led to improved efficiency and reduced administrative burdens in growing firms, showcasing the practical outcomes of these technologies. Furthermore, implementing real-time dashboards offers instant insights into financial performance, facilitating timely decision-making.

Integrating AI-driven approaches enables the analysis of trends and cash flow predictions, empowering accountants to proactively manage finances. Regular assessments of automation strategies are essential to ensure they adjust to changing business requirements, thereby maximizing their efficacy in improving overall efficiency. Sage emphasizes that 40% of new staff select practices based on their reputation, highlighting the competitive edge that efficient automation can provide in attracting top talent.

Training and Support: Key to Successful IT Implementation

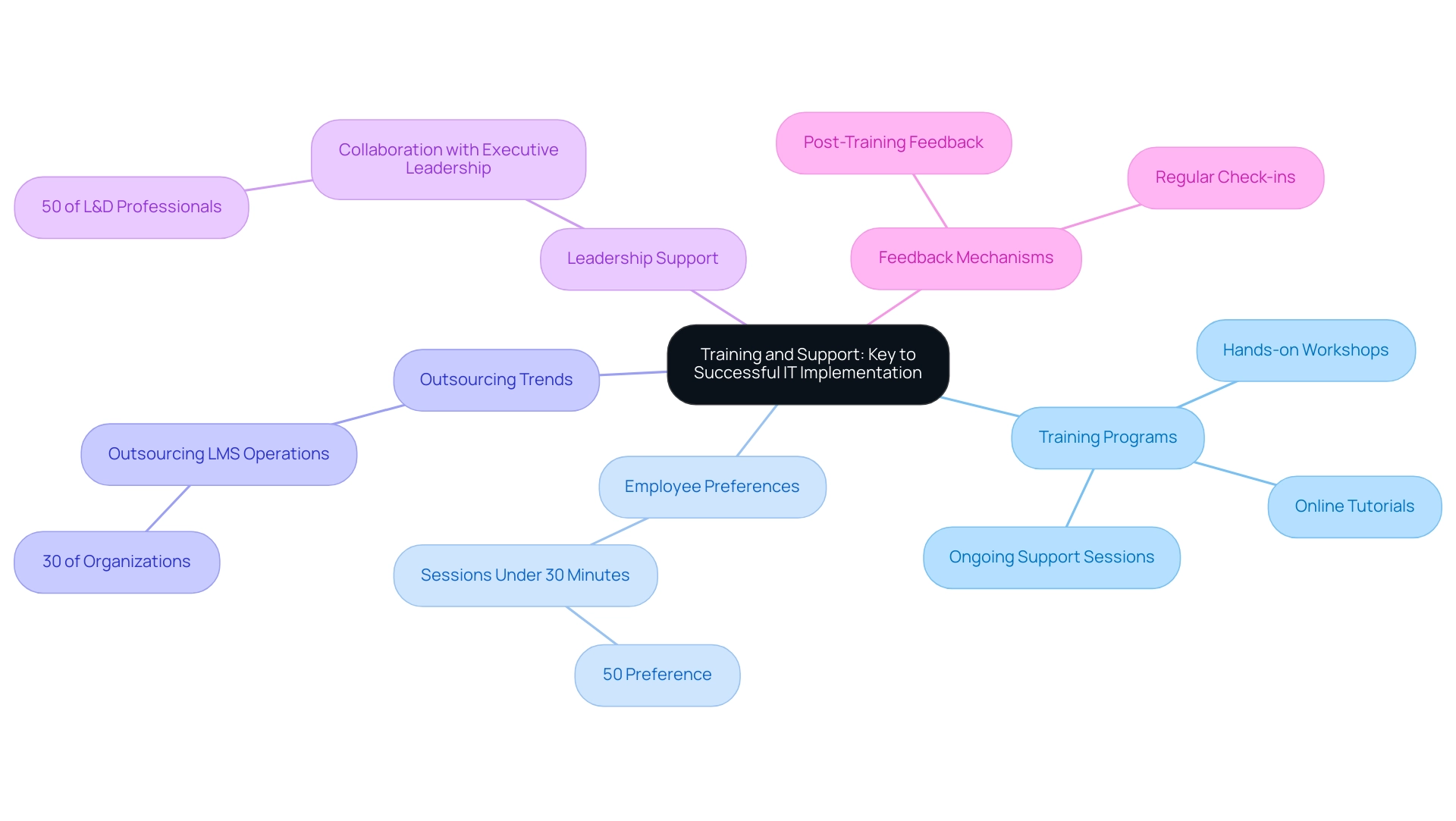

Implementing new IT approaches without sufficient training can significantly hinder their adoption, leading to both underutilization and frustration among staff members. To mitigate these risks, it is essential to develop a comprehensive training program that integrates:

- Hands-on workshops

- Engaging online tutorials

- Ongoing support sessions

Acknowledging that 50% of employees prefer training sessions lasting less than 30 minutes, structuring training to optimize engagement is crucial.

This statistic informs the design of training modules, ensuring they are concise and focused. Furthermore, the trend of outsourcing LMS operations, where on average 30% of organizations are doing so, illustrates how companies are enhancing training efficiency through specialized services. Establishing a culture of continuous learning can be achieved by providing readily available resources such as FAQs and user guides.

Additionally, as highlighted by recent news, 50% of L&D professionals collaborate closely with executive leadership, emphasizing the importance of leadership support in training initiatives. Designating 'champions' within your team can create a supportive environment where these individuals assist others and share best practices, fostering a collaborative learning atmosphere. Collecting feedback post-training is vital for refining future programs that incorporate IT solutions for accountants, ensuring they effectively address the specific challenges faced by accountants.

Regular check-ins can reinforce learning and guarantee that the technology continues to align with evolving business needs, ultimately enhancing the overall effectiveness of IT solutions for accountants.

Conclusion

Selecting and implementing the right IT solutions is paramount for accounting firms aiming to enhance efficiency and adapt to the evolving landscape of the industry. By conducting a thorough needs analysis and evaluating various software options, firms can identify tools that align with their specific requirements, from compliance to user accessibility. The rise of cloud accounting and automation technologies presents unique opportunities to streamline operations and improve client interactions, with many firms already leveraging these innovations to achieve greater flexibility and responsiveness.

Successful implementation of these IT solutions hinges on a structured approach that includes:

- Comprehensive training

- Ongoing support

Engaging team members early in the process fosters ownership and commitment, while pilot testing enables firms to refine their strategies before full deployment. Continuous evaluation and adaptation of both technology and training programs ensure that firms remain equipped to meet the dynamic demands of the accounting profession.

Ultimately, embracing advanced technologies is not merely about keeping pace with industry trends; it is about positioning firms for sustained growth and operational excellence. By prioritizing the selection and implementation of the right IT solutions, accounting firms can enhance their competitive edge, achieve greater efficiency, and better serve their clients in an increasingly complex environment. The commitment to innovation will drive success, enabling firms to thrive as they navigate the challenges and opportunities that lie ahead.